With a $30 trillion meta-verse market on the horizon, here are three stocks to buy

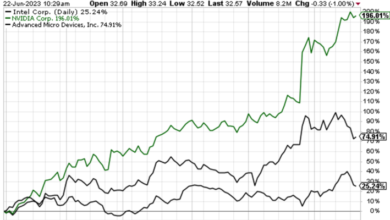

With its Omniverse platform and graphics chips, Nvidia should be one of the greatest metaverse winners.

Unity’s objective is for its tools to be used to create the majority of metaverse content

- Nvidia

At least one person believes the metaverse market is worth more than $30 trillion. In August, Nvidia (NASDAQ: NVDA) CEO Jensen Huang remarked that the metaverse “is going to be a new economy that is larger than our current economy” during his company’s second-quarter conference call. Last year, the global economy surpassed $80 trillion.

Even if Huang’s prediction is excessively optimistic, Nvidia should be one of the major winners in the metaverse. The company’s Omniverse platform is a ready-to-use portion of the metaverse. Omniverse allows for 3D modeling and design cooperation.

Omniverse Avatars, one component of this virtual platform, has a $40 billion annual market potential. Despite the fact that I don’t believe Nvidia can grab the entire market, I believe Omniverse will be a huge commercial success for the firm over the next decade and beyond.

However, I believe that Nvidia’s graphics chips will provide an even greater potential. If the metaverse lives up to the promise, demand for these chips will undoubtedly skyrocket. Today, Nvidia is the most popular graphics chip manufacturer. It will, without a doubt, remain at the top of the metaverse.

- Meta Platforms

With its name change from Facebook, Meta Platforms (NASDAQ: FB) fouled up the FAANG stocks. However, I agree with the company’s decision to emphasize that its future is intertwined with the metaverse. I believe the future is bright.

Meta is the only firm that has presented a more vivid image of what the metaverse could become. No other corporation, arguably, will invest as much in the metaverse as Meta will.

Meta is a company that creates virtual and augmented reality gadgets. It’s working on a new metaverse operating system. It’s developing a platform for digital commerce. The business is developing content studios and, predictably, a metaverse social platform.

Mega’s goal, according to CEO Mark Zuckerberg, is to “assist a billion people use the metaverse and support hundreds of billions of dollars in digital commerce” by the end of this decade, according to the company’s Q3 conference call. Meta, in my opinion, will achieve that purpose while also making investors extremely wealthy.

- Unity Software

Nvidia’s Omniverse and Meta’s development efforts will not be enough for the metaverse to reach its full potential. To complete the metaverse, millions of content providers will be necessary. Unity Software (NYSE: U) aspires to be the company that gives those creators the tools they require.

Unity’s platform was used to create 71% of the top 1,000 mobile games by the end of 2020. The corporation wants to ensure that its products are used to create a similar percentage of metaverse content.

Unity’s recent acquisition of Weta Digital appears to be a big step in the right direction. The company already has the tools needed for programmers to create 3D games. Unity can also suit the needs of artists thanks to Weta’s visual effects technologies.

With shares trading at roughly 43 times sales, the stock may appear to be pricey. Regardless of whether the market is closer to $8 trillion or $30 trillion, Unity should have a huge opportunity with the metaverse.