India is emerging as a robust economy amidst growing concerns of a recession in developed economies. The country’s stock markets have reached all-time highs, reflecting the optimism of fund managers and investors.

The rally is driven by factors such as global liquidity, the “Make in India” initiative, and the consumption theme. With a long-term perspective, India’s economic prospects for the next decade appear promising, fueled by the startup culture, successful business listings, and a growing corporate and equity culture.

Solid Foundation for Growth:

Over the past five years, the Indian government has implemented initiatives that have laid a solid foundation for economic takeoff. Successful resolution of banking non-performing assets (NPAs) and real estate issues, focus on infrastructure development, the Digital India campaign, prudent fiscal management during the pandemic, and emphasis on renewable energy are among the key achievements.

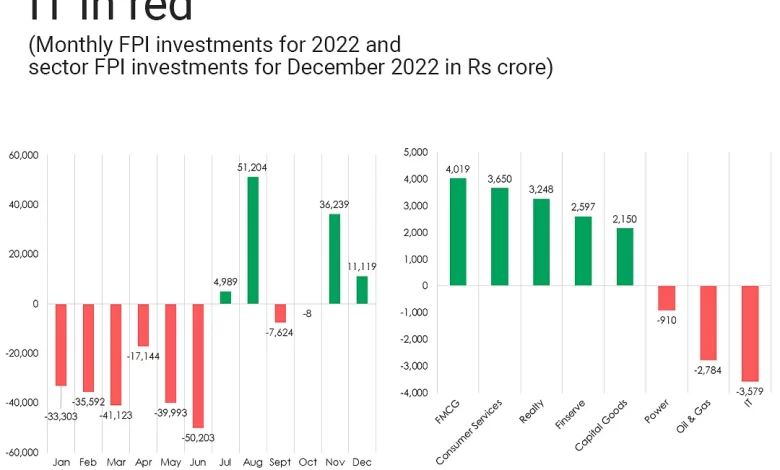

The “Make in India” campaign has gained momentum, attracting global manufacturers to shift their operations to India. Sectors such as FMCG, automotive, real estate, banking, and financials have delivered impressive returns in recent months. Moreover, the breadth of the market rally indicates that the India growth story is already in motion.

Opportunities and Challenges:

While India’s mid-cap and small-cap segments offer significant potential for returns as they remain underowned, valuations in frontline stocks appear fairly priced. India traditionally carries a higher valuation compared to other emerging markets due to its large population, per capita income, and growth potential.

In the shorter term, India may experience a slowdown due to the global economic downturn, rising interest rates, and reduced global demand. However, even in the face of global challenges, India’s economy demonstrates resilience and offers a more favorable outlook compared to other economies.

Global Economic Turmoil:

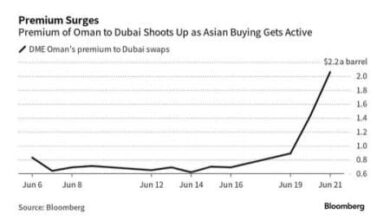

The global economy is entering a long deflationary phase, evident from declining commodity and crude prices. The ongoing global slowdown is expected to intensify, leading to a prolonged period of economic turmoil.

The investment community is divided in its outlook on equities, with certain tech stocks driving market rallies while a majority of stocks struggle. Artificial intelligence is seen as a transformative force, but it may also be subject to valuation hype and potential bubble risks in the short term.

China’s Decline and India’s Opportunity: China’s economy is grappling with long-term structural issues, resulting in capital flight and the relocation of manufacturing facilities by multinational corporations. The country’s banking and real estate challenges, coupled with its massive debt, pose significant obstacles.

China’s reopening efforts have fallen short, contributing to global fears of demand compression, as reflected in slipping commodity and crude prices. Additionally, China’s aging and declining population will negatively impact its workforce and overall economic activity in the coming decades. India stands to benefit from China’s decline, but precautions are necessary to avoid a repeat of Japan’s economic stagnation over the past three decades.

Conclusion:

Despite concerns about a global recession, India’s economy stands out as a strong contender. With its solid foundation, growing sectors, and favorable demographics, India is poised for substantial value creation over the next five to ten years.

While short-term challenges may arise from the global economic slowdown, India’s resilience and potential make it an attractive investment destination. Investors should closely monitor global economic developments while recognizing India’s promising long-term prospects.

Read the original article on Financial Reports