While global recession concerns have led to a decline in global oil prices to levels seen before the Ukraine war, prices of Middle Eastern oil have experienced a significant increase. This surge in prices is primarily driven by the soaring demand from Asian refiners, particularly in China and Japan. The market has taken notice of the heavy trading activity conducted by major industry players this month.

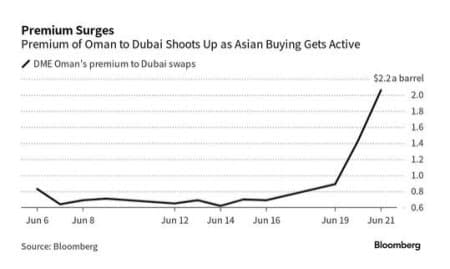

Spike in Spot Differentials

Spot differentials for August-loading Oman crude have risen to over $2 per barrel against the Dubai benchmark, compared to 60-70 cents per barrel the previous week. Additionally, premiums for Abu Dhabi’s Murban grade have also seen an increase. It is uncommon for spot differentials to exhibit such significant fluctuations between days and deals. The rise in regional prices can be attributed to Asian refiners, including China’s Rongsheng Petrochemical, Taiwan’s Formosa Petrochemical, and processors in Japan and Thailand, who have been actively purchasing oil barrels in the past few days.

Increased Trading Activity in the Middle Eastern Crude Market

The surge in trading activity on the usually calm Middle Eastern crude-trading window has drawn the attention of market participants. Unipec, a subsidiary of China’s top refiner Sinopec, along with TotalEnergies SE and Shell Plc, have been actively involved in bidding and offering Dubai crude partial contracts on the Platts trading window this month. These activities have a direct impact on pricing the benchmark of the same name.

Role of Dubai Partial Contracts

Cargoes of crude, including Oman, Murban, and other Middle Eastern grades, can be delivered from the seller to the buyer through the transaction of a specified number of Dubai partials. Typically, shipments consist of 500,000 barrels, and Oman is considered one of the easiest to handle due to its high export volume and broad buyer and seller base.

Record Activity on the Platts Window

Data compiled by Bloomberg reveals that nearly 40 Oman cargoes and two Upper Zakum shipments from the United Arab Emirates have been delivered so far this month. This level of activity on the Platts window is unprecedented in recent years. However, the number of Oman shipments accounts for nearly 70% of the grade’s exported volume in recent months. Traders are now questioning whether sellers, such as Unipec, might reduce offers if physical cargoes become scarce. These concerns have contributed to the price increase and could potentially lead to further hikes if sellers struggle to acquire window-deliverable cargoes.

Shift in Market Sentiment and Prices

The sharp increase in sentiment and prices marks a significant turnaround from earlier this month when traders were uncertain about the market’s direction due to contrasting trading on the window. Companies may actively engage in buying and selling on the window due to their associated positions in the Brent and Dubai paper markets.

Backwardation in Dubai Swaps and Brent-Dubai EFS

The backwardation in prompt Dubai swaps strengthened to its highest level in six weeks on Wednesday. Meanwhile, the premium of London’s Brent crude over the Middle Eastern benchmark, known as Brent-Dubai EFS, remained narrow at under $1 per barrel. Earlier this month, Saudi Arabia surprised the market with additional output cuts, which led to a spike in official prices across all regions.

Shifting Demand from Asia to Europe and the U.S.

Last month, cargoes of Oman, Upper Zakum, and Murban crude for July loading were transacted for Europe and the United States, which was considered unusual as Asian demand was weak at that time. However, the situation has since reversed, and China has re-entered the market.

China’s Return to the Market

Western buyers have found Middle Eastern crude to be affordable due to the muted demand from Asia caused by refiners undergoing planned maintenance work. However, China’s renewed presence in the market indicates a shift in the dynamics.

In conclusion, Middle East oil prices have surged due to increased demand from Asian refiners, particularly in China. Heavy trading activity by major industry players has driven up prices, and the market is closely monitoring the situation. The rise in spot differentials and record activity on the Platts window are notable indicators of the current market conditions.

Read the original article on Financial Reports