Tesla has entered a bear market as its market capitalization has fallen below $1 trillion.

Tesla Inc.'s market capitalization dipped below $1 trillion on Monday, with a 5% drop putting the electric vehicle company in a bear market for the third time this year.

On Monday, Tesla Inc.’s market capitalization slipped below $1 trillion. The EV producer is now in a bear market for the third time this year as a result of the 5% drop. The stock is also down almost 21% from its November 4 record closing high of $1,229.91.

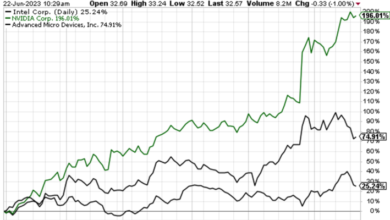

In October, Tesla’s market capitalization surpassed $1 trillion. However, the stock has maintained annual gains and outperformed the larger equities market. Tesla has risen 37 percent so far this year, compared to the S&P 500 index’s gain of 24 percent.

TSLA shares are down 4.98 percent. closed at $966.41, taking the stock’s December losses to more than 154 percent, making it the stock’s worst month since March 2020.

The stock’s finish on Monday was the lowest since Oct. 22, when it closed at $909.68.

The stock is also down more than 21% from its record closing high of $1,229.91 on Nov. 4, indicating a bear market, which is defined as a drop of at least 20% from a top, according to many Wall Street analysts. Tesla is currently in its third bear market of the year.

In late February and mid-May, the stock experienced a bear market. Since late June, Tesla has been in a bull market.

In October, Tesla’s market capitalization surpassed $1 trillion, following news that Hertz Global Holdings Inc. planned to acquire 100,000 Tesla automobiles.

However, the stock has maintained annual gains and outperformed the larger equities market. Tesla has risen 37 percent this year, compared to a 24 percent increase for the S&P 500 index. -0.91% on the S&P 500.